50%: Essential Expenses

According to the rule, half of your income should go towards essentials expenses, such as rent or mortgage, groceries, utilities, and other unavoidable fixed costs. The 50% guideline ensures that you can cover these basic needs without experiencing financial strain. If your essential expenses exceed 50% of your income, consider finding ways to cut back, such as reducing grocery or energy costs.

- Rent or mortgage

- Groceries

- Utilities

- Insurance

- Taxes

- Medications

30%: Leisure

The next 30% of your income is allocated for discretionary spending —your “leisure” fund. This includes expenses for clothing, entertainment, streaming subscriptions, and dining out. These elements add enjoyment to life, and while they are not essential, treating yourself occasionally can help you keep motivated. However, it is important to set priorities within this 30% to ensure you stay within your budget.

- Clothing

- Entertainment / Dining out

- Vacations

- Hobbies

- Gadgets

20%: Saving, Investing, or Debt Repayment

The remaining 20% of your income is allocated for your future—your “safety net.” This portion is designated for savings, which can help you prepare for unexpected expenses, such as a broken phone or car repairs. Additionally, you may want to set aside money for larger future expenses, such as education or a major purchase.

Once you have built up enough savings to cover emergencies, you might consider investing this portion, such as in stocks. If you have any debt, it is wise to use this 20% to pay it off as quickly as possible, since interest can cause debt to grow rapidly. Paying off your debt will prevent financial stress.

- Savings

- Investments

- Debt repayment

Why Does the 50/30/20 Rule Work?

The 50/30/20 rule is popular because it is simple—no complex calculations are required. You simply divide your income into three categories. This approach helps you maintain a balanced perspective on what you need, what you want, and what you should save for the future.

However, the 50/30/20 rule is not rigid; it can be adjusted as needed. For instance, you might choose to spend more on leisure in one month by saving a bit less. You can also customize the allocation to fit your individual situation. For example, freelancers who need to save for their own retirement may want to allocate a larger portion to savings compared to employees with an employer-sponsored pension.

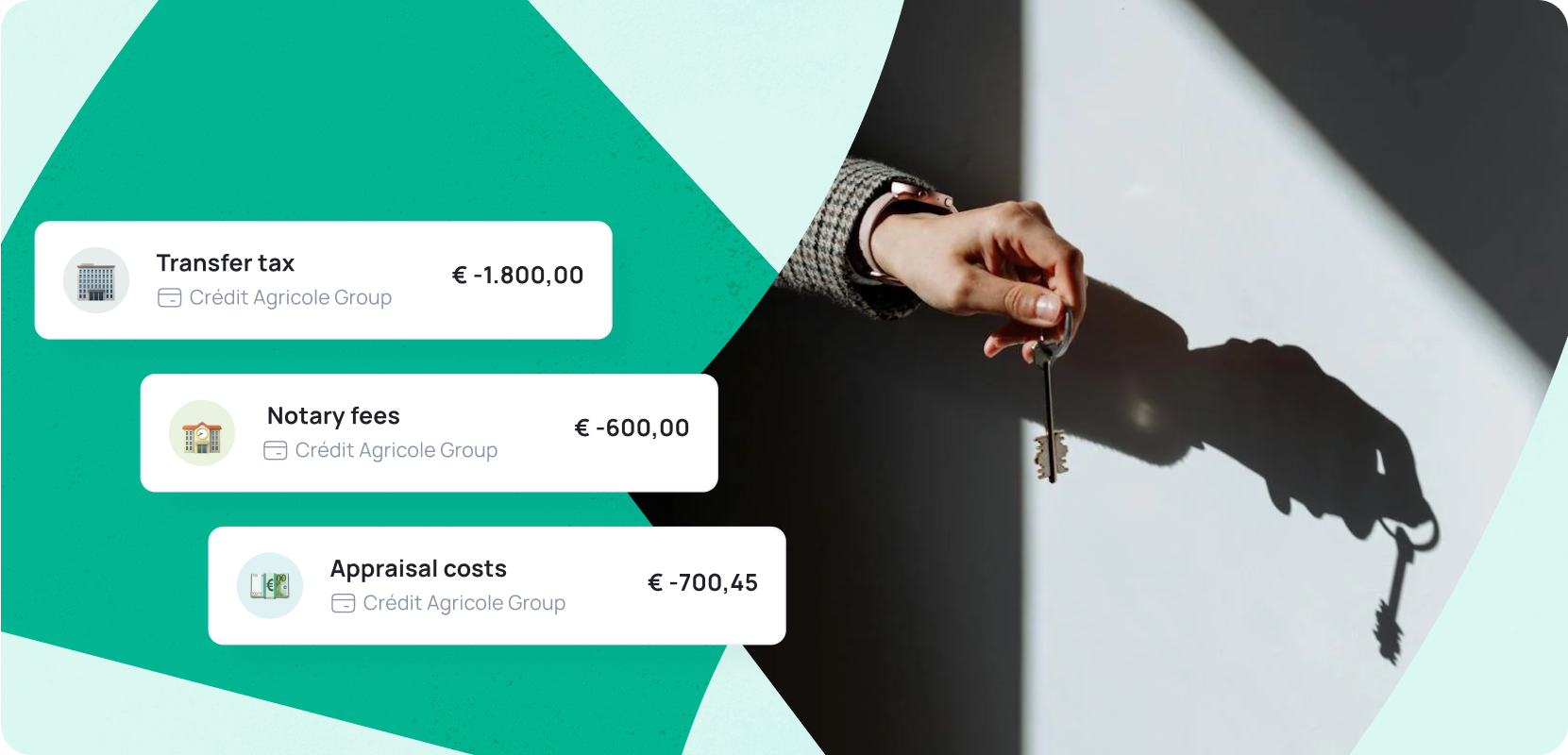

Grassfeld for Budgeting

The free Grassfeld app helps you track your finances. You can easily categorize transactions and manage your budget, allowing you to see if you are adhering to the 50/30/20 rule and make adjustments as necessary. With a premium subscription, your transactions are automatically synced and categorized, simplifying the budgeting process even further.